Paycheck 2023 Biweekly Payroll Calendar Template – Only 18% of employers use the semi-monthly payment frequency, which ranks it second in popularity behind the monthly payment plan (only 4.4% of employers use it).

But what business structure is best for a semi-monthly payroll? We’ll cover all of this and more, so let’s dive in!

Paycheck 2023 Biweekly Payroll Calendar Template

A semi-monthly payment schedule means that you pay employees twice a month on specific pay days – usually the 1st and 15th or the 15th and last day of the month. This means that employees receive 24 salaries each year.

Free Excel Timesheet Calculator Template 2023

Now that we’ve answered that burning question, let’s take a closer look at the 2023 monthly payment calendar.

Here is a free printable 2023 semi-monthly payment schedule template that can be used with Google Sheets or Microsoft Excel. Simply click “Make a copy” to start working on your own.

When you give a salaried employee half their monthly salary, divide their annual gross salary by 24 – the total number of pay periods.

Bi Weekly Payroll Calendar

For example, let’s say you pay an employee $72,000 per year using a semi-monthly salary calendar. Divide $72,000 by 24 to get $3,000. In other words, you pay them a gross salary of $3,000 each pay period.

The calculation of the half-monthly salary for employees is different from the calculation for employees, as employees do not receive a fixed annual salary.

You consider a semi-monthly salary, but pay periods may end in the middle of the work week. This means that employees will receive different amounts each paycheck and the math will be a bit more complicated for you.

Changing Payroll Frequency

Let’s say you run a restaurant and have an employee who works 44 hours in a typical work week. You must pay them on March 30. But it’s Thursday – right in the middle of their work week! So what are you doing? Divide their salary into two periods.

Of these 44 hours, 28 hours per payment period (before March 30) and 16 hours on an ongoing basis (after March 30) are lost.

Since anything over 40 is considered overtime, 28 regular hours in the previous pay period and 12 regular hours and 4 overtime in the current pay period are paid. Add that to the other hours they worked each pay period and you get their pay.

Your Guide To The 2023 Semimonthly Pay Schedule

It may not seem easy. And it’s not – especially if you have more than two employees. That’s why we recommend using a payroll solution like , which totals the hours and automatically calculates your payment. What’s more, they also send paychecks!

When deciding on a payment plan, you usually have to decide between a semi-monthly or bi-weekly payment plan.

With bi-weekly schedules, you pay an employee every two weeks – usually on the same day of the week. With 52 weeks in a typical year, this breaks down to 26 paychecks each year.

Free Excel Calendar Templates

This difference in annual pay is what differentiates a semi-monthly paycheck (24 paychecks) from a biweekly paycheck, because two extra paychecks means you have two months of extra paychecks.

If you have a consistent monthly income, you may find it easy to budget with semi-monthly payment schedules, as your paychecks stay consistent throughout the year. On the other hand, a biweekly pay schedule makes it easier to calculate overtime pay for employees because work weeks coincide with pay periods. Simply put, a semi-monthly payment plan is the best way to go if your employees are receiving a primary salary. But if you have employees, every two weeks sounds better.

You can choose any payment schedule. Be sure to choose what is best for your business and your employees. A correct payroll schedule simplifies your accounting work and makes your employees happy.

Types Of Wages

Still, a semi-monthly payment schedule is one of the best options if you have salaried employees. Simply divide their annual salary by 24. Get started with our free template today! So your business is growing and you’re hiring. It’s definitely an exciting time, but it comes with a lot of questions, especially if you’re a first-time employer.

One of the questions you need to figure out before you start hiring employees is “How often should I do payroll?”

As a business owner, this is entirely up to you, but the most popular payroll is bi-weekly. But what exactly is this payment plan? And is there a calendar you can follow? We’ve delved into all of this and more, so keep reading!

Bi Weekly Vs Semi Monthly Pay Periods: Differences And Benefits

A bi-weekly payment schedule means that you pay your employees every other week on a specific day of the week. For example, you can send employees paychecks every other Friday. Since there are 52 weeks in the year, there are 26 pay periods in a biweekly payment plan in a calendar year.

According to the US Bureau of Labor Statistics, 43% of businesses use a bi-weekly payment plan, making it the most common payment plan.

In 2023, there will be 26 pay days on a two-week schedule. Most employers use Friday as the payday because holidays such as Labor Day and Memorial Day fall on a Monday.

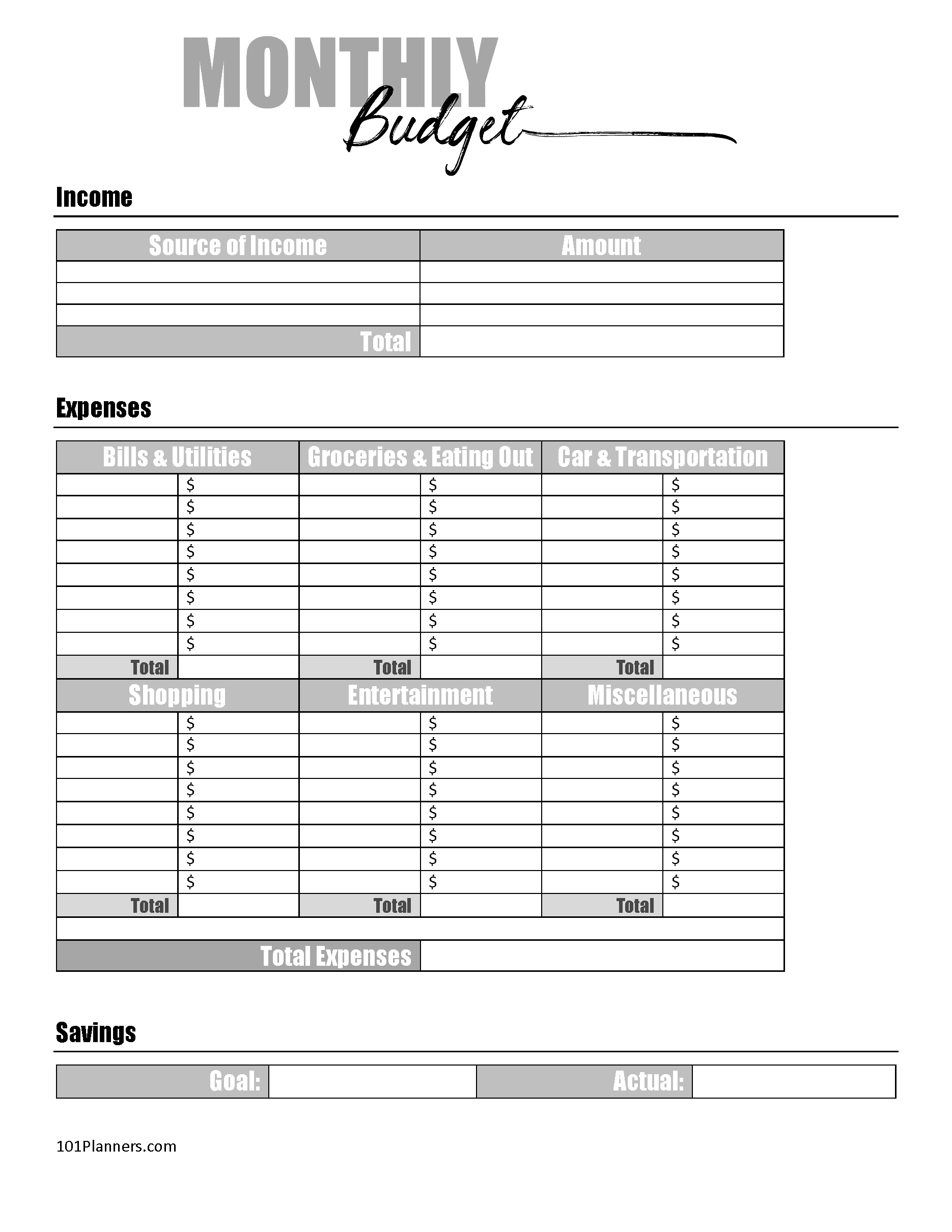

Bi Weekly Budget Planner Template Paycheck Budget Printable

Here’s a free printable 2023 biweekly salary schedule template that you can use with Microsoft Excel or Google Sheets. (Just click “Make a copy” to get your version.)

If you want to make payroll even easier, take a look. A payroll platform automatically calculates wages and pays your employees and takes care of your payroll taxes, reducing the time, energy and resources required for payroll.

To calculate gross pay for employees, divide the total pay by 26 (the total number of pay periods).

Free Payment Schedule Template: Examples

For example, let’s say you have a full-time office worker who earns $44,200. Dividing $44,200 by 26 gives you $1,700 in gross wages for each period (Gross wages are the total amount paid to your employee before payroll taxes are deducted.)

Want to know how much they make per hour? Perhaps you want to check if an employee earns more than the minimum wage set by your local, state or federal government?

Divide their salary by 2,080 non-overtime hours per year. So for the example above, we divide $44,200 by 2,080 hours. Pays $21.25 an hour.

How To Fill Out A Budget Sheet (simple Tutorial With Paycheck Blocking)

You can calculate team member pay by multiplying the total number of hours worked between the start date of the pay period and the end date of the pay period by their rate.

So if you have an employee who is paid $15 an hour and works 60 hours, his gross pay would be $900. Then you must deduct payroll taxes, which include FICA (for Social Security and Medicare) and federal income tax.

Assume that this employee’s tax withholding includes 7.65% Social Security and Medicare taxes (FICA taxes) and 12% federal income tax. This means you will withhold a total of 19.65% of gross pay, which is $176.85. Your employee’s net pay after taxes for this period is $723.15.

Bi Weekly Budget Overview Template Printable Paycheck Budget

There are several factors to consider when choosing a salary schedule, including the amount of administrative work involved, industry standards, and employee preferences. Here are the most common and some things you may want to consider when making your purchase.

From a business owner’s perspective, less frequent paychecks are great because they involve less work. For example, using a monthly calendar means you only need to do payroll 12 times a year.

Monthly payroll can be a more affordable option for businesses that do their own payroll, which takes time and resources, or those that work with a payroll service provider that charges them each time. (However, if you have, you can run unlimited payroll and pay your employees as often as you like.)

Academic Personnel Payroll Deadlines

Finally, depending on the type of workers you hire and where you do business, you may need to pay your workers more than once a month. For example, you must pay employees at least twice a month.

This option is great for employees. This gives them an incentive to work every week and feel more financially secure. Instead of watching their bank account melt away over the course of the month, it steadily grows each week, which is a huge benefit.

Weekly plans are also particularly suitable for employees. They often have different work schedules and with a weekly payment it is much easier to see how much they have earned so far. This can help them determine if they are ready to pay rent, bills and other expenses, or if they need to do more work before the end of the month.

Best Budgeting Template Printables

However, these schedules can require more administrative work to process the weekly payroll—unless you have a service like , which does it for you automatically as often as you like.

This is also the most commonly used method. This means that this is a familiar schedule for many employees. So when you hire new employees, it’s more likely that they’ve already had experience with that pay frequency, making that part of the transition smooth.

Some months are longer than others and that means pay day